When it comes to Forex trading, understanding pips is crucial for beginners looking to navigate the complex world of currency trading. Pips, short for “percentage in point”, represent the smallest price movement in the exchange rate of a currency pair. They play a significant role in determining profits and losses in Forex trading. In this beginner’s guide, we will explore the importance of pips, how to calculate them, and how to use them effectively to measure your trading performance.

Understanding Pips in Forex Trading

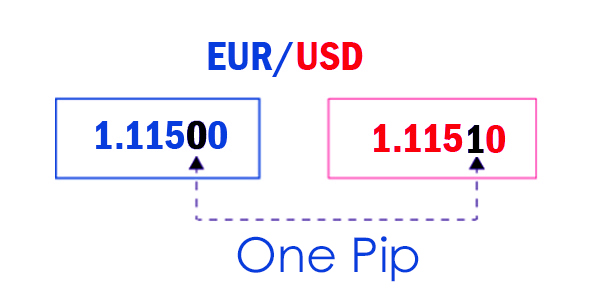

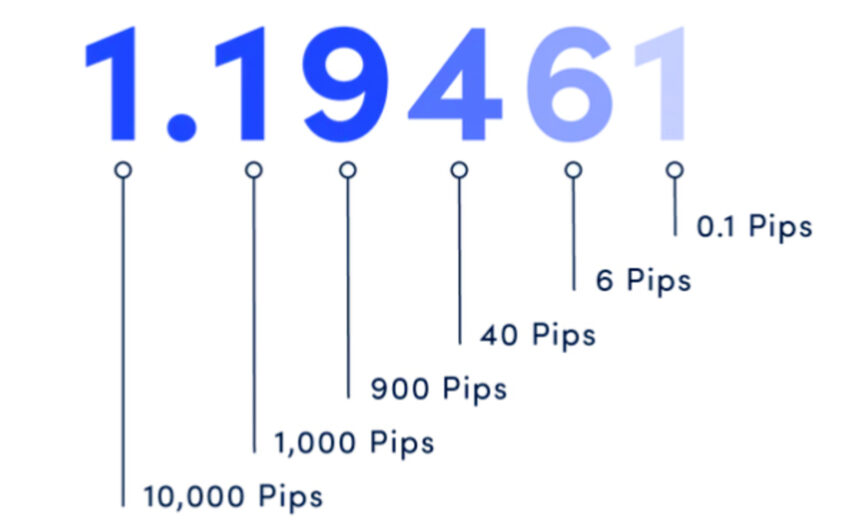

Pips are the basic unit of measurement in Forex trading, representing the change in value between two currencies. For most currency pairs, a pip is equivalent to 0.0001 of a unit of the quoted currency. For example, in the EUR/USD currency pair, a move from 1.2000 to 1.2001 would represent a one pip increase. Understanding how pips work is essential for traders to calculate their potential profits and losses accurately.

Importance of Pips for Beginners

For beginners in Forex trading, grasping the concept of pips is essential for making informed trading decisions. Pips not only help traders determine the value of a trade but also play a crucial role in calculating risk and reward ratios. By understanding pips, beginners can effectively manage their trades and set realistic profit targets.

How to Calculate Pips in Forex

Calculating pips in Forex is a straightforward process once you understand the basics. To calculate the value of a pip in a currency pair, you need to know the lot size and the exchange rate. The formula for calculating pips is as follows: Pip Value = (One Pip / Exchange Rate) * Lot Size. By using this formula, traders can determine the value of each pip movement in their trades.

Using Pips to Measure Profit and Loss

Pips are used to measure the profit or loss in a trade, making them a valuable tool for assessing trading performance. By tracking the number of pips gained or lost in a trade, traders can evaluate the success of their strategies and make adjustments as needed. For example, if a trader buys a currency pair at 1.3000 and sells it at 1.3100, they would have gained 100 pips.

Tips for Managing Pips Effectively

- Set realistic profit targets based on the number of pips you aim to gain in a trade.

- Use stop-loss orders to limit potential losses and protect your capital.

- Keep track of your pips gained or lost to evaluate your trading performance over time.

Common Mistakes to Avoid with Pips

- Overleveraging trades without considering the potential impact on pips.

- Ignoring the spread when calculating pips, which can affect profitability.

- Focusing solely on pips without considering other factors like market conditions and trends.

Comparison Table: Spread vs. Pips

| Metric | Spread (in pips) | Pips (Price Movement) |

|---|---|---|

| Definition | The difference between the buy and sell prices offered by a broker | The smallest price movement in the exchange rate of a currency pair |

| Importance | Affects the cost of each trade and can impact profitability | Used to measure profit and loss in a trade |

In conclusion, understanding pips is essential for beginners in Forex trading to navigate the market effectively. By learning how to calculate pips, measuring profit and loss, and managing them strategically, traders can improve their trading performance and make informed decisions. Remember to avoid common mistakes related to pips and consider other factors that may impact your trades. With practice and experience, mastering the concept of pips can lead to success in the dynamic world of Forex trading.

‘Percentage in point’ makes so much more sense now. I’m ready to start using this knowledge in my trades.

I didn’t realize how important pips were for trading decisions. This guide is really useful for beginners like me.

Thanks for explaining the comparison between spread and pips. It clarified their different roles in trading.

Great explanation on pips! Now I know they represent the smallest price movement in currency pairs.

This article helped me finally understand what pips are in Forex trading. Now I know how to calculate them!

Calculating pips seems easier after reading this. The formula provided is straightforward and clear.

Understanding how to use pips strategically can make a big difference in setting realistic profit targets!

“Don’t ignore the spread when calculating pips” – such an important point that I overlooked before!

“Using stop-loss orders” is a great tip! Helps manage risks by limiting potential pip losses.

I learned that tracking pips can help evaluate trading performance. This will definitely improve my strategy!