When it comes to trading in the foreign exchange market, being able to read and interpret forex charts is essential. Forex charts provide valuable information about currency pairs, helping traders make informed decisions about buying or selling. Whether you are a beginner or an experienced trader, understanding how to read forex charts is crucial for success in the forex market.

Understanding the Basics of Forex Charts

Forex charts are graphical representations of the price movements of currency pairs over a certain period of time. The x-axis represents the time frame, while the y-axis represents the price. By looking at forex charts, traders can analyze historical price data and identify trends. Common types of forex charts include line charts, bar charts, and candlestick charts.

Identifying Different Types of Forex Charts

Line charts are the simplest form of forex charts and connect closing prices of a currency pair over a period of time. Bar charts provide more detailed information, showing the opening, closing, high, and low prices of a currency pair. Candlestick charts are the most popular type of forex charts, displaying the same information as bar charts in a more visually appealing way.

When it comes to reading Forex charts, there are a few key basics that every trader should be familiar with. Here are some essential concepts to keep in mind:

| Candlesticks | Bar Charts | Line Charts |

|---|---|---|

| Provide visual representation of price movements | Show open, high, low, and close prices for a specific period | Connect closing prices of a currency pair over time |

Interpreting Candlestick Patterns in Charts

Candlestick patterns are an important tool for forex traders as they can indicate potential market reversals or continuations. Common candlestick patterns include doji, hammer, engulfing, and shooting star. By understanding these patterns, traders can make better decisions about when to enter or exit a trade.

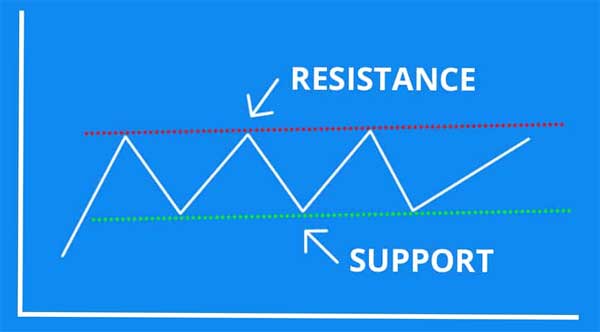

Using Support and Resistance Levels in Analysis

Support and resistance levels are key components of technical analysis in forex trading. Support levels represent price levels where a currency pair tends to find buying interest, while resistance levels are price levels where selling interest is typically found. By identifying these levels on forex charts, traders can make more accurate predictions about future price movements.

Utilizing Technical Indicators for Chart Analysis

Technical indicators are mathematical calculations based on historical price and volume data, which can help traders analyze forex charts. Popular technical indicators include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. By using these indicators in conjunction with forex charts, traders can make more informed trading decisions.

Incorporating Fundamental Analysis in Forex Charts

In addition to technical analysis, fundamental analysis plays a crucial role in interpreting forex charts. Fundamental factors such as economic indicators, central bank policies, geopolitical events, and market sentiment can influence currency prices. By keeping track of these factors and incorporating them into forex chart analysis, traders can gain a more comprehensive understanding of the market.

Reading forex charts may seem overwhelming at first, but with practice and the right knowledge, it can become a valuable skill for any trader. By understanding the basics of forex charts, identifying different types of charts, interpreting candlestick patterns, using support and resistance levels, utilizing technical indicators, and incorporating fundamental analysis, traders can make more informed trading decisions in the forex market. Remember, practice makes perfect, so keep analyzing forex charts regularly to improve your trading skills.

I’m new to trading, but this article gave me confidence to start reading forex charts more seriously.

Learning about candlestick patterns is very helpful. Now I can spot trends better.

The explanation of moving averages was clear and informative. It simplifies chart analysis a lot!

The explanation of technical indicators like RSI and MACD was informative. I’ll definitely use these in my analysis.

‘Practice makes perfect’ is a great reminder. Regularly analyzing charts will improve my trading skills.

This article explains forex charts really well. It’s good for beginners like me.

With practice, reading these charts will surely become second nature. Great introductory guide!

I didn’t know about the different types of charts before. Now I understand line, bar, and candlestick charts!

‘Candlestick charts are visually appealing,’ indeed! They give more detailed info than line charts.

Central bank policies affecting forex charts is a new insight for me. Very informative read!

The article explains the basics of forex charts really well. It’s good to know what line, bar, and candlestick charts are.

Fundamental analysis adds another layer to chart reading. It’s essential for understanding market moves.

Support and resistance levels are crucial. The article made it easier to identify them on charts.

I found the section on candlestick patterns very helpful. Now I know what doji and hammer patterns mean!

I learned that understanding historical price data can help identify trends in currency pairs. Very useful!

Understanding support and resistance levels is important for predicting price movements. The article makes it clear.

The combination of technical and fundamental analysis offers a well-rounded approach to forex trading. Good advice!

Technical indicators like RSI and MACD seem useful for analysis. I’ll try using them more.

‘Line charts are simple but effective for quick overviews,’ as the article says. Helpful for beginners like me!

Incorporating fundamental analysis into forex chart reading is something I need to work on. Thanks for the insight!