In the high-stakes arena of forex trading, leverage is a double-edged sword that can amplify both gains and losses. Proper management of leverage risk is essential for traders seeking to navigate the tumultuous currency markets successfully. This article dives into the critical aspects of leverage risk in forex trading and outlines strategies and tools to effectively manage this risk, adapting to market volatility and safeguarding investments.

Understanding Leverage Risk

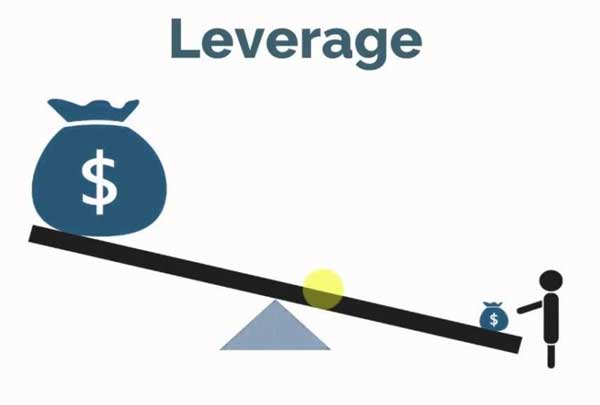

Leverage in forex trading allows traders to control large positions with a relatively small amount of capital. It is expressed as a ratio, such as 50:1, where a trader with $1,000 in their account could control a position of $50,000. While leverage can magnify returns, it also increases exposure to potential losses, making it one of the most significant risks in forex trading. Here’s why leverage risk demands attention:

- Amplified Losses: Small market movements can lead to substantial losses due to the highly leveraged position.

- Margin Calls: If the market moves against a leveraged position, traders may face a call to deposit additional funds to maintain the trade.

- Rapid Market Changes: High leverage leaves less room to maneuver when the market changes quickly, potentially leading to forced liquidation.

- Interest Costs: Leveraged positions often incur rollover interest costs, which can add up over time and affect profitability.

- Overexposure: Traders may inadvertently overexpose themselves to risk by using excessive leverage without proper risk management strategies in place.

- Psychological Pressure: Managing a highly leveraged position requires a steady nerve, as the increased risk can lead to stress and poor decision-making.

Strategies to Mitigate Risk

To protect themselves from the dangers of leverage, traders can employ various strategies. Risk mitigation is about balance—managing potential rewards against the likelihood of losses. Here are six strategies to consider:

- Conservative Leverage Usage: Utilize lower levels of leverage to reduce the size of potential losses.

- Diversification: Spread trading capital across different currency pairs and strategies to minimize risk concentration.

- Education and Research: Stay informed about market conditions and economic indicators that can affect currency values.

- Risk-Reward Evaluation: Before entering a trade, assess if the potential upside justifies the risk taken.

- Position Sizing: Calculate the size of positions based on a percentage of the trading account to avoid overexposure.

- Regular Monitoring: Keep a constant eye on open positions to react quickly to market changes.

The Role of Stop-Loss Orders

Stop-loss orders are an essential tool for managing leverage risk in forex trading. They allow traders to set a predetermined level at which a trade will close to prevent further losses. The importance of stop-loss orders lies in their ability to:

- Cap losses on individual trades.

- Protect trading capital from significant market swings.

- Allow traders to set their maximum risk tolerance.

- Provide peace of mind by automating risk management.

- Help preserve account balance during volatile market periods.

- Enforce discipline by preventing emotional decision-making.

Importance of Risk Management

Risk management is the cornerstone of successful forex trading, especially when using leverage. Without it, even the most talented traders can suffer catastrophic losses. The key components of effective risk management include:

- Understanding personal risk tolerance.

- Using stop-loss orders strategically.

- Regularly reviewing and adjusting risk parameters.

- Keeping emotions in check to avoid impulsive decisions.

- Maintaining adequate capital levels to withstand drawdowns.

- Staying informed about geopolitical and economic factors that can influence markets.

Tools for Monitoring Leverage

Traders have access to a variety of tools for monitoring and managing leverage risk. These tools can help to avoid costly mistakes and enhance decision-making:

- Margin Calculators: To determine how much margin is required for a particular trade.

- Risk Management Software: Provides real-time analysis of exposure and potential risk.

- Trading Platforms: Often include features to monitor leverage and margin levels automatically.

Comparison Table: Features of Tools for Monitoring Leverage

| Tool | Margin Calculator | Risk Management Software | Trading Platform |

|---|---|---|---|

| Ease of Use | High | Medium | High |

| Real-Time Analysis | No | Yes | Yes |

| Automated Features | No | Yes | Yes |

| Customization | Low | High | Medium |

| Cost | Free | Variable | Free-Variable |

| Accessibility | High | Medium | High |

Adapting to Market Volatility

Market volatility can be both a threat and an opportunity for leveraged forex traders. Adapting to market volatility requires:

- Flexibility: Adjusting strategies and positions in response to market conditions.

- Awareness: Keeping a close eye on economic announcements and news events that can trigger volatility.

- Speed: Being able to act quickly to take advantage of market movements or cut losses.

- Stress Testing: Regularly testing strategies against historical data to see how they might perform during volatile times.

- Contingency Planning: Having a plan for extreme market events or technological failures.

- Continuous Learning: Staying up-to-date with market analysis and trading techniques to navigate volatile markets effectively.

In conclusion, while leverage can significantly increase the potential for profit in forex trading, it is critical for traders to understand and manage the associated risk. By employing strategies such as using stop-loss orders, understanding risk management, and utilizing the appropriate tools, traders can navigate the forex market’s inherent volatility. Adapting to changing market conditions is vital, and a disciplined approach to leverage can lead to long-term success in the challenging world of forex trading.

I learned a lot about managing leverage risk. Very informative.

Leverage can be risky. This article helps understand how to manage it.

Adapting to market volatility is key. Great advice in the article.

The strategies to mitigate risk are helpful. Good read for beginners.

Stop-loss orders are crucial. I will use them more in my trades.

Risk management is very important in forex trading. Thanks for the tips.

This article explains leverage risk well. Important for forex traders.

Tools for monitoring leverage are useful. I will try margin calculators.