Market psychology plays a crucial role in determining the behavior of investors and the overall performance of financial markets. Understanding and managing emotions such as fear and greed can help investors avoid making rash decisions during turbulent times. One of the most common emotions that can negatively impact investment decisions is panic. In this article, we will explore the concept of market psychology, how to recognize panic behavior, the impact of panic on markets, strategies to avoid panic, the importance of emotional control, and how to maintain a rational perspective.

Understanding Market Psychology

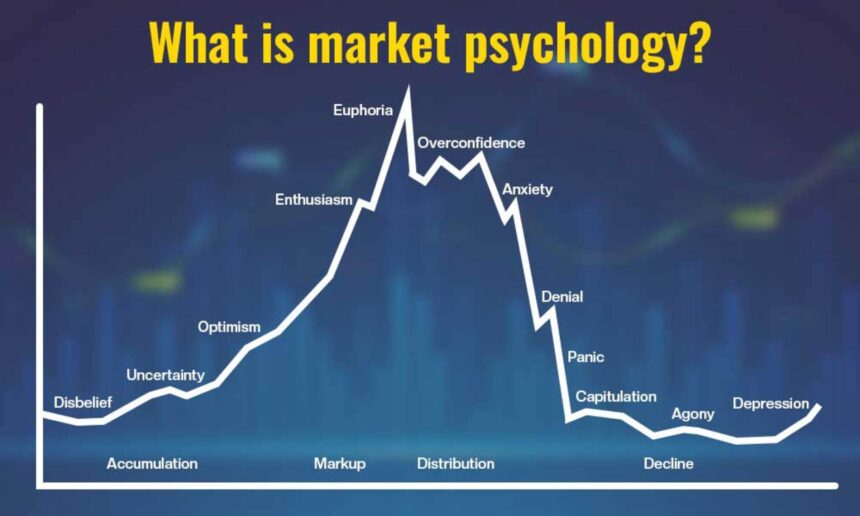

Market psychology refers to the collective mindset of investors and how their emotions influence their decision-making process. Factors such as fear, greed, and herd mentality can drive market movements and create trends that may not be based on rational analysis. Understanding market psychology can help investors anticipate market movements and make more informed decisions.

Recognizing Panic Behavior

Panic behavior in the market is characterized by irrational selling or buying based on fear and uncertainty. Signs of panic include sharp declines in asset prices, high trading volumes, and extreme volatility. Investors succumb to panic when they feel overwhelmed by negative news or uncertain economic conditions, leading to impulsive actions that can result in significant losses.

Impact of Panic on Markets

Panic selling can exacerbate market downturns and create a self-reinforcing cycle of fear and selling pressure. This can lead to dramatic price declines and increased market volatility. The impact of panic on markets can be far-reaching, affecting not only individual investors but also the overall stability of the financial system.

| Comparison Table | Behavior | Impact |

|---|---|---|

| Rational Investor | Makes informed decisions based on analysis and research | Helps stabilize markets and reduce volatility |

| Panicked Investor | Reacts impulsively to negative news or market conditions | Contributes to market instability and sharp price declines |

Strategies to Avoid Panic

- Diversification: Spread investments across different asset classes to reduce risk.

- Long-term Perspective: Focus on the long-term goals of investments rather than short-term fluctuations.

- Stay Informed: Keep abreast of market developments and seek advice from financial professionals.

Importance of Emotional Control

Emotional control is crucial in avoiding panic and making rational investment decisions. By managing emotions such as fear and greed, investors can maintain a disciplined approach to investing and avoid falling prey to market hysteria. Emotional control can help investors stay focused on their long-term investment objectives.

Maintaining a Rational Perspective

To maintain a rational perspective in the face of market volatility, investors should:

- Conduct thorough research and analysis before making investment decisions.

- Avoid making impulsive decisions based on short-term market fluctuations.

- Seek advice from financial advisors or professionals to gain a better understanding of market conditions.

By understanding market psychology, recognizing panic behavior, and implementing strategies to avoid panic, investors can navigate volatile market conditions with confidence and resilience. Maintaining emotional control and a rational perspective are essential components of successful investing in the long run. Remember, markets may fluctuate, but staying true to your investment goals and principles can help you weather the storm and emerge stronger on the other side.

Emotional control seems so important for investing. This article makes it clear why.

This article explains market psychology really well. Helps understand how emotions affect investing.

I didn’t know panic could have such a big impact on markets. Really interesting read.

The comparison table is helpful. Shows the difference between rational and panicked investors.

Good tips on avoiding panic! Diversification and staying informed are key.

This article highlights how fear and greed drive markets. Very informative for new investors!

Understanding market psychology can really give an edge in investing. Good insights here!

Great strategies to avoid panic! Long-term perspective is something I need to focus on more.

Recognizing panic behavior is crucial. I’ll try to keep a rational perspective from now on.

Staying informed and seeking advice can definitely help in making better investment decisions.