Revenge trading is a common pitfall that many traders face in the financial markets. It occurs when a trader seeks to recoup losses by making impulsive and emotional trades, often leading to further losses. In order to avoid the dangers of revenge trading, it is important to understand the underlying emotions that drive this behavior and to establish a solid trading plan with effective risk management strategies. Seeking support and accountability from peers, as well as embracing a healthy mindset, are also crucial in maintaining a disciplined approach to trading.

The Dangers of Revenge Trading

Revenge trading can have detrimental effects on a trader’s financial well-being and mental health. Some of the dangers associated with revenge trading include:

- Increased losses: Emotional trading can cloud judgment and lead to poor decision-making, resulting in further losses.

- Damage to reputation: Consistently engaging in revenge trading can harm a trader’s credibility and reputation in the market.

- Stress and anxiety: The constant cycle of winning and losing can take a toll on a trader’s mental and emotional well-being, leading to stress and anxiety.

Understanding Emotional Trading

Emotional trading is often driven by fear, greed, or the need to be right. By recognizing these emotions and understanding their impact on trading decisions, traders can take steps to mitigate their effects. Some strategies for dealing with emotional trading include:

- Practicing mindfulness: Being present and aware of one’s emotions can help prevent impulsive decision-making.

- Taking breaks: Stepping away from the screen and giving oneself time to reflect can help reduce the influence of emotions on trading.

- Journaling: Keeping a trading journal can help track patterns of emotional trading and identify triggers.

Establishing a Trading Plan

A solid trading plan is essential in avoiding revenge trading. A trading plan should include:

- Clear entry and exit points: Having predetermined levels at which to enter and exit trades can help prevent emotional decision-making.

- Risk management rules: Establishing risk management strategies, such as setting stop-loss orders and position sizing, can protect against large losses.

- Trading goals: Setting realistic goals and sticking to them can help maintain focus and discipline in trading.

Utilizing Risk Management Strategies

Risk management is crucial in avoiding revenge trading and preserving capital. Some risk management strategies to consider include:

- Setting stop-loss orders: Placing stop-loss orders can limit potential losses and protect against emotional decision-making.

- Diversifying investments: Spreading investments across different assets can help reduce overall risk exposure.

- Position sizing: Determining the amount of capital to risk on each trade can prevent overexposure and minimize losses.

Seeking Support and Accountability

Seeking support from peers and mentors can provide valuable feedback and guidance in avoiding revenge trading. Accountability partners can help hold traders accountable to their trading plans and goals. Joining trading communities or forums can also provide a sense of camaraderie and encouragement in the face of challenges.

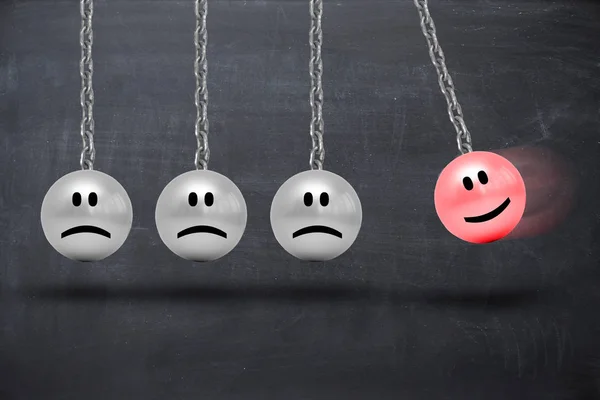

Embracing a Healthy Mindset

Maintaining a healthy mindset is essential in navigating the ups and downs of trading. Some ways to cultivate a healthy mindset include:

- Practicing self-care: Taking care of one’s physical and mental well-being can help reduce stress and improve decision-making.

- Focusing on the process, not just the outcome: Emphasizing the importance of following a trading plan and executing trades according to strategy can help detach from emotional attachment to outcomes.

- Celebrating small wins: Acknowledging and celebrating small victories can boost confidence and motivation in trading.

Comparison Table

| Revenge Trading | Disciplined Trading |

|---|---|

| Emotion-driven | Rule-based |

| Impulsive decisions | Strategic planning |

| Increased losses | Controlled risks |

| Negative impact on mental health | Positive reinforcement |

By understanding the dangers of revenge trading, recognizing emotional triggers, and implementing effective risk management strategies, traders can avoid falling into the trap of revenge trading. Seeking support and accountability, as well as embracing a healthy mindset, are key components in maintaining a disciplined approach to trading. Remember, successful trading requires a combination of skill, strategy, and emotional intelligence.

Embracing a healthy mindset is so important. Good read!

Good tips on avoiding revenge trading. It’s important to have a solid plan!

I need to work on my trading plan more. Thanks for the pointers!

Very informative article. Setting stop-loss orders is key to managing risk.

I didn’t know emotional trading could be so damaging. Great advice on mindfulness.