In the high-stakes arena of foreign exchange trading, a strategy known as scalping is gaining momentum among traders looking for quick, repeated gains. Forex scalping is a trading technique that relies on making numerous trades within a very short time frame, capitalizing on small currency price changes. This article unfolds the intricacies of forex scalping, providing a minute-by-minute breakdown of the strategy and offering insights into the tools, risk management practices, indicators, and advanced techniques that can help traders harness the potential of this high-frequency trading approach.

Forex Scalping Explained

Forex scalping is a trading strategy used by traders to make profits from small price changes in the forex market. Scalpers, as they are known, aim to enter and exit trades within minutes, sometimes holding a position for just seconds. The essence of scalping is to accumulate small gains consistently throughout the trading day which can potentially add up to substantial profits. Scalpers must have a strict exit strategy as a large loss could eliminate the many small gains that they have worked to obtain. Key characteristics of scalping include:

- High volume trading

- Short-term trade holding periods

- A focus on liquid pairs to ensure quick entry and exit

- A disciplined exit strategy

- Utilization of leverage to amplify gains

- A fast-paced and demanding trading style

Tools for the Scalping Trader

To engage in forex scalping effectively, traders need access to several tools:

- High-Speed Internet Connection: Given the need for rapid execution, a slow internet connection can be detrimental to a scalper’s success.

- Reliable Trading Platform: A platform that offers real-time data, quick order execution, and low slippage.

- Direct Market Access (DMA): This allows traders to place buy and sell orders directly with the exchange, bypassing traditional brokers.

- Trading Software: Some scalpers use automated trading systems that can execute trades based on pre-set parameters.

- Access to Market Information: Up-to-minute news feeds and alerts are critical to stay informed about market-moving events.

- Efficient Risk Management Tools: Stop-loss orders and automated trade rules are essential for preserving capital.

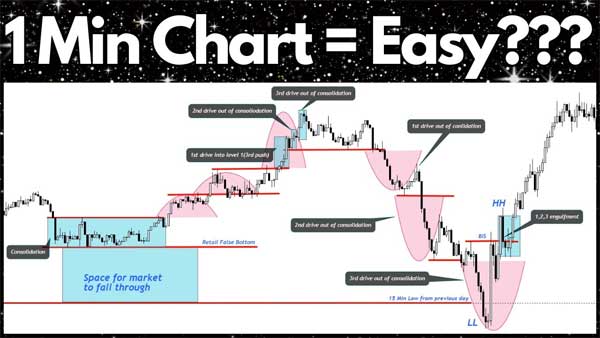

Mastering the Minute Chart

A minute chart is a primary tool in a scalper’s arsenal, providing a detailed view of price movements:

- Time Frames: Scalpers typically use one-minute to five-minute charts to identify trading opportunities.

- Price Action: Reading the price action on these charts is crucial for deciding entry and exit points.

- Trends: Although trends on a minute chart are short-lived, they can be indicative of potential trade opportunities.

- Support and Resistance Levels: These are used to determine stop-loss and take-profit levels.

- Pattern Recognition: Scalpers often look for specific patterns that indicate possible immediate price movements.

- Volume: Analyzing trade volume can help confirm the strength or weakness of a price movement.

Risk Management in Scalping

Risk management is vital for scalping, given the high volume of trades and the use of leverage:

- Position Sizing: Controlling the size of trades to ensure that losses can be easily absorbed.

- Stop-Loss Orders: Essential for limiting losses on each trade.

- Take-Profit Orders: Set to ensure profits are realized before market reversals can occur.

- Daily Loss Limit: A cap on the total losses a trader is willing to accept in a day to avoid emotional trading.

- Risk-Reward Ratio: Scalpers typically employ a tight risk-reward ratio, often risking more than they stand to gain on a single trade.

- Continuous Monitoring: Due to the quick pace, traders need to constantly monitor their positions and market conditions.

Essential Scalping Indicators

Scalpers use a variety of indicators to guide their trading decisions:

- Moving Averages: To determine the direction of the market trend.

- Stochastic Oscillator: To identify overbought and oversold conditions.

- Fibonacci Retracements: For pinpointing potential reversal levels.

- Bollinger Bands: To gauge market volatility and potential price breakouts.

- MACD (Moving Average Convergence Divergence): To find changes in momentum, direction, and duration of a trend.

- Relative Strength Index (RSI): To determine the strength of current market conditions.

Advanced Scalping Techniques

For the seasoned scalper looking to enhance their strategy, advanced techniques can provide an edge:

- Level 2 Quotes: Provides insight into the market depth and liquidity, allowing for better decision-making on entry and exit points.

- Order Flow Analysis: Understanding the flow of buy and sell orders can be critical in predicting short-term price movements.

- Market Sentiment Analysis: Gauging the sentiment of market participants can offer clues about potential market directions.

- Algorithmic Trading: Automated trading systems can execute trades faster than humans, an advantage in scalping.

- Correlation Trading: Utilizing the relationship between currency pairs to capture gains.

- Scalping in Ranges: Specializing in trading within defined price ranges during periods of market consolidation.

Comparison Table: Scalping vs. Other Trading Strategies

| Feature | Scalping | Day Trading | Swing Trading | Position Trading |

|---|---|---|---|---|

| Trade Duration | Seconds to minutes | Hours to a day | Days to weeks | Weeks to months |

| Frequency | Very high | Moderate | Low | Very low |

| Required Attention | Constant | High | Moderate | Low |

| Risk Level | High | High | Moderate | Low |

| Potential Profit per Trade | Low | Moderate | High | Very high |

| Strategy Complexity | Moderate to high | Moderate | Moderate | Low |

Forex scalping is not a strategy for the faint of heart, requiring intense focus, rapid decision-making, and a firm grasp on various trading tools and practices. The allure of accumulating incremental gains through this minute-by-minute trading strategy is tempered by the stringent demands placed on the trader, including the need for precise risk management and the ability to interpret a wealth of market data accurately. For those with the discipline and fortitude to master the nuances of scalping, the forex market provides a dynamic and potentially profitable trading landscape. As with any trading approach, education, experience, and a well-calibrated strategy are the cornerstones of success for those looking to thrive in the world of forex scalping.